Videomenthe & ProConsultant Informatique become Bminty

Advertising Growth in the First Quarter of 2024: Increase in Digital, Optimistic Forecasts Thanks to the Olympic Games

22 May 2024

LOREM IPSUM

At the beginning of January, several studies were forecasting strong growth in the advertising market (see our article), linked to the economic recovery, major sporting and political events, and new platforms.

The Baromètre Unifié du Marché Publicitaire (Bump), published annually by Irep, France Pub and Kantar Media, confirms this growth in net advertising revenues of +3.8% in the first quarter of 2024 compared with 2023. This growth is marked above all by the 23% increase in digital media revenues, an area that far exceeds pre-pandemic levels (+72.2% vs. 2019).

12 Mars 2019

Performance of individual media

📺Television: net TV advertising revenues rebounded by +6.3% compared to 2023, but are still slightly below 2019 levels (-2.6%).

🎙️Radio: the sector is performing very well, with growth of +4.5%, exceeding 2019 levels (+4.7%).

🎥 Cinema: Growth of +5.2%, but still down on 2019 (-22%).

🔲Out-of-home advertising: Growth of +5.7%, exceeding pre-crisis levels (+2.6%), with a sharp rise in DOOH, Digital Out Of Home (+29.2%), identified at the start of the year as one of the big trends in the advertising sector (see our article on the 10 2024 trends in advertising)

📝 Press: Down -2.2% on 2023, widening the gap with 2019 (-14.9%). Translated with DeepL.com (free version)

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

12 Mars 2019

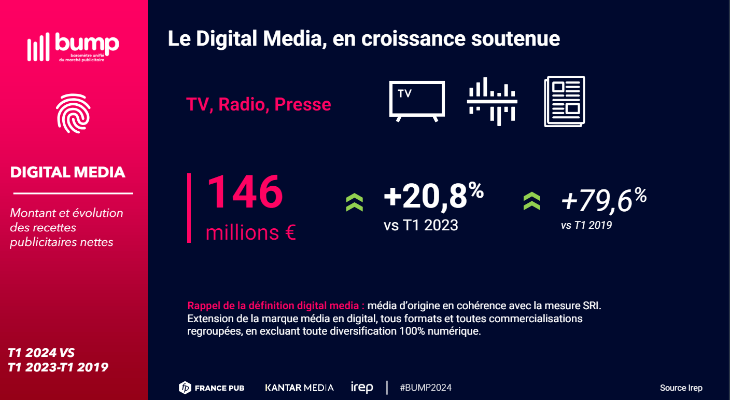

Digital media, spearheading advertising revenues

Total growth in the TV, radio and press digital media sector (i.e., the extension of a media brand into digital, all formats and all marketing combined, excluding any 100% digital diversification) is estimated at +20.8% compared to 2023, and +79.6% if compared to 2019.

IREP notes very strong growth in audio (+27%) and video (+31%) formats.

🔉The term digital audio includes all media brand extension formats: web radio, voice assistants, podcasts, and this regardless of the device used.

📹 The term digital video includes the display of video advertising in the video stream (in a player, pre-roll, mid-roll and post-roll).

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

12 Mars 2019

Sectors in difficulty

- Advertising mail: Continuing decline (-6.4% vs. 2023, -33.3% vs. 2019).

- Paper leaflets: Sharp fall (-14%), despite the rise of digital leaflets (+56.4%). As we mentioned in our article, the decline in paper leaflets represents an opportunity for other sectors, notably digital and TV (only if legislation changes for the latter).

Advertiser market

- Digital: the sector is clearly dominated by Meta (97% of advertisers), with significant investment on Instagram.

- E-commerce: Amazon dominates with 86% share of voice, while CDiscount, Alibaba, Shein, and Temu share the rest.

Themes and forecasts

The Corporate social responsibility (CSR) theme clearly stands out, with a clear focus on the automotive sector and green cars. The top 10 CSR advertisers include 9 automotive brands!

The 2024 Olympic Games are set to boost the market, with sponsorship surpluses and additional advertising investment expected.

Lorem ipsum

At Videomenthe, we help brands, agencies, TV channels and more to produce inclusive, international content and measure audiences across all distribution channels. Our SaaS platform Eolementhe offers you simple and effective features for managing your content.

LOREM IPSUM

SDH subtitling (Deaf and hard of hearing)

Increase the inclusiveness of your content to reach a wider audience.

Audience measurement

Evaluate the effectiveness of your content distribution channels using Kantar Media's audience measurement watermarking, integrated into our Eolementhe solution.